Disruptive tech providers, new banking regulations, obscure deadlines and thresholds – these are challenges we face with clients every day. What many others still fail to see though, is that in an age of accelerating change, having a clear vendor negotiation strategy - and executing it well - is becoming more critical to bank and credit union executives than ever before.

To help spare others from costly lessons learned, here is a list of our best and most often given advice for preparing for a negotiation - or renegotiation. With our experts’ combined experience in the field, and $3.6 billion proof points behind us, these are SRM’s eight rules of engagement for effective vendor management.

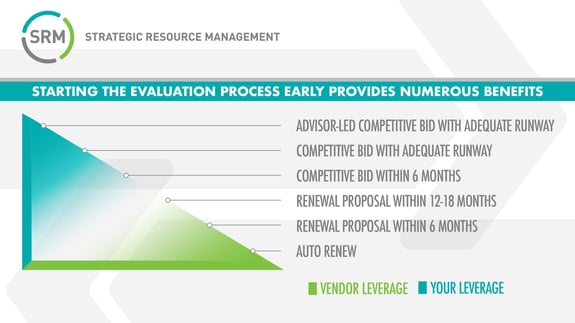

1. Start Renewal Discussions Early.

Most technology vendor contracts are for three to seven years and many include provisions for autorenewal and/or advance notification of termination, which is often set six months prior to contract expiration, but can be earlier. SRM advocates that financial institutions (FIs), do contract due diligence - even for renewals – to prevent a situation where FIs pay more than necessary for services rendered.

We’ve even seen some clients make a practice of submitting their notice of non-renewal at signing (dated to match the contract’s end), to make sure the task isn’t overlooked. The vendor, for their part, must provide notice of service termination or the agreement goes month-to-month. This is just one example of the extent to which the vendor contract review exercise has become a game requiring a high degree of attention and expertise.

2. Even if You’re Content, You Should Review.

FIs must maintain contract negotiation leverage, regardless of the quality of the relationship, and, with technology cost curves trending downward and user bases growing daily, additional volume discounts and other pricing adjustments may be on the table - but hidden in the fine print.

In addition, new features and improved performance will have debuted since the initial contract was inked. A contract renewal should be considered a good opportunity to renew understanding of the market landscape, check for blind spots, and benchmark pricing - whereas simply saying “No changes, here is my signature,” often translates to paying above-market rates.

Market Brief: Return More Value To Members – Cost-Effectively Monitor Vendor Contracts

3. Treat Amendments as Carefully as New Contracts.

While addressing contract updates via an amendment of a few pages, there are far too many examples of amendment language found to later conflict with the original agreement, leading to disputes down the road - even rendering portions of the contract unenforceable. Contract nuances are financially AND legally important. Whoever is leading negotiations should thoroughly understand the fine print, the logic behind the language used, and all possible ramifications.

4. Beware the Perils of Free Money.

While more often a feature for new contracts, it’s not an uncommon negotiation tactic for a vendor to offer a signing bonus. Having a vendor negotiation strategy in place allows you to step back and think objectively. For example, how does the vendor plan to recoup the value of the bonus? One way can be by proposing pricing that is above the market rate.

The purpose of incentives, like signing bonuses, is to convince decision-makers to quickly agree and draw attention away from competitors. In these contract negotiation scenarios, leverage grows by collecting proposals from multiple vendors.

5. Good Business is Smart Business.

Decision-makers need to remain objective to avoid costly mistakes. While they do have a current view in their specialty area, the account rep should never be their primary source of market intelligence. It can be a mistake to think that all of the facts are always clearly presented, even the ones that can cost the vendor your business. Due diligence is smart business.

White Paper: Level the Playing Field When Negotiating Long-Term Vendor Contracts

6. Bid Out Every Contract.

In any vendor negotiation strategy, the logical outcome of the five preceding points is to bid out every contract. There is no better source of intelligence than the competitive marketplace. Unless you have someone dedicated to the position, it’s unrealistic to expect staff to remain abreast of the latest developments while also juggling their daily priorities. In order to stay on top of a vendor’s value to your institution, what better way is there than to reach out to resources who make it their business to respond with specific information and insights?

While we recommend a tightly managed RFP process, started as early as possible, it would be an overstatement to call this free information. Running a bid process is time-consuming work, but this exercise pays for itself, both qualitatively and monetarily. Even if the result is contract renewal, management can demonstrate with confidence to its board and auditors that it has negotiated costs to align current (and future) capabilities with its go-to-market strategy.

7. Don’t Give Regulators a Reason to Dig for Dirt.

In early 2019, both the FDIC and NCUA put out statements to tighten oversight and documentation of their supply chain management and business continuity processes, particularly in the technology arena. The NCUA and FDIC are clearly telegraphing their intention to pay closer attention to areas of vendor contract management in their examination process. Conclusion? Those who can demonstrate a solid due diligence process governing vendor selection will spend less time under the magnifying glass.

8. Ask for Outside Help.

Vendor selection isn’t easy. Few would debate the importance of a vendor negotiation strategy, but it tends to fall into the “I’ll deal with it tomorrow” position, behind more visible and time-sensitive matters. That’s where a set of dedicated eyes can be helpful, particularly ones that are experts in the vendor management field. Make no mistake, decision-makers can save themselves much time and grief by efficiently sourcing and leveraging expertise familiar with developing these critical functions.

TAB Recovers Costs by Tracking, Auditing andOptimizing your Vendor Database

The Bottom Line: The most important takeaway of these eight rules of engagement is having the right information at the right time. Whether that’s by conducting market research, issuing RFPs, or calling in specialized reinforcements, leveraging resources to gain a deep and current understanding of vendor dynamics is becoming mission critical. Consider working with a partner like SRM in managing the RFP process and deciphering incoming responses, providing counsel on in-market alternatives, and assisting with vendor negotiations to ensure a win/win outcome.